Introduction: Why Gold Shines in Indian Portfolios

Gold has been a cornerstone of Indian investments for centuries, offering stability, protection against inflation, and a hedge against economic uncertainty. As 2024 unfolds, gold continues to hold its allure as a reliable investment, especially amid fluctuating global markets.

Types of Gold Investments in India

- Physical Gold

- Includes jewelry, coins, and bars.

- Costs involve making charges, GST, and storage fees.

- Gold ETFs (Exchange-Traded Funds)

- Traded on stock exchanges, these are low-cost investments requiring a Demat account.

- Sovereign Gold Bonds (SGBs)

- Issued by the Indian government, offering fixed annual interest and capital gains tax benefits.

- Digital Gold

- Allows fractional gold ownership without physical handling.

- Gold Mutual Funds

- Invests in gold ETFs, providing easy liquidity.

Benefits of Investing in Gold

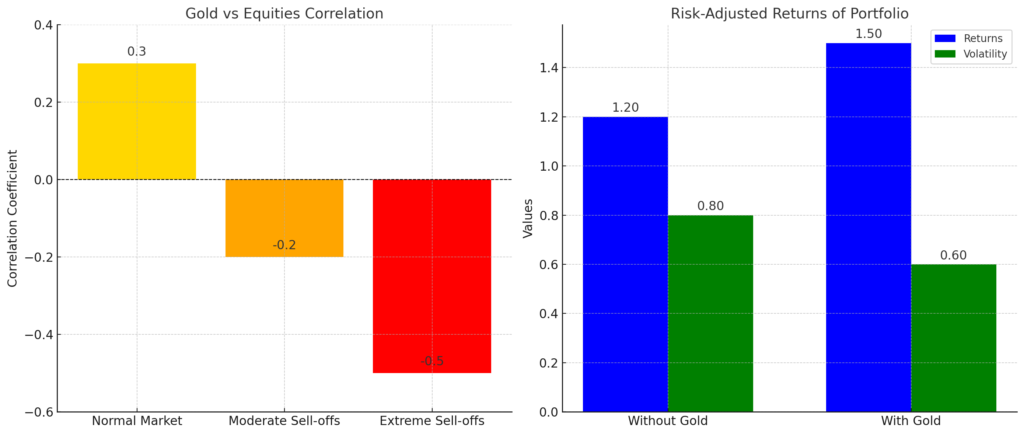

- Portfolio Diversification: Gold’s negative correlation with equities ensures stability during market downturns.

- Inflation Hedge: Historically, gold retains purchasing power during inflationary periods.

- Liquidity: Options like digital gold and ETFs can be sold quickly.

- Crisis Resilience: Gold prices often surge during geopolitical or economic crises.

Challenges of Gold Investment

- High Costs: Physical gold includes making charges and storage fees, while digital gold has spreads.

- Market Volatility: Short-term investments can be risky.

- Regulatory Changes: Investors need to stay informed about tax and compliance requirements.

Comparative Analysis: Popular Gold Investment Options

| Investment Type | Cost Involved | Liquidity | Returns Potential |

|---|---|---|---|

| Physical Gold | High making/storage fees | Medium | Market-dependent |

| Gold ETFs | Low expense ratio | High | Linked to gold prices |

| Sovereign Gold Bonds | No visible expenses | Medium | Fixed interest + price gains |

| Digital Gold | 3% GST + 6% spread | High | Market-dependent |

| Gold Mutual Funds | 0.5-1.2% expenses | High | Linked to gold ETFs |

Key Charts and Insights

- Gold vs. Equities Correlation: During market sell-offs, gold’s correlation with equities turns negative, reducing overall portfolio risk (World Gold Council, 2024).

- Risk-Adjusted Returns: Portfolios with gold show improved returns and lower volatility.

Why Now?

Gold’s enduring value makes it a timeless investment. Whether you are safeguarding your wealth or seeking growth, gold offers an unmatched balance of stability and opportunity. Start small, stay consistent, and let gold illuminate your financial journey.

Conclusion: Embrace the Power of Gold in Your Portfolio

Gold remains an invaluable asset for Indian investors, offering a perfect blend of stability, diversification, and potential for long-term growth. With various investment options like Sovereign Gold Bonds, ETFs, and Digital Gold, there’s something for every investor, regardless of budget or risk appetite. By understanding the challenges and leveraging smart strategies like staggered buying and portfolio diversification, you can maximize gold’s potential in your financial plan.

In a world filled with uncertainties, gold acts as a beacon of security and opportunity. So, whether you’re looking to preserve wealth or build a strong foundation for future financial goals, now is the time to harness the timeless value of gold.

💡 Take Action Now! Start your journey into gold investment today and unlock a golden future for your finances. The earlier you begin, the brighter your financial horizons will be!

Relevant Links and Resources

- Financial calculators

- Open demat account

- NSE India

- BSE India

- MCX (multi commodity exchange)

- AMFI (association of mutual fund India)

References