What is Equity Investment?

Equity investment involves purchasing shares of companies, making you a partial owner. As these companies grow and succeed, so does your wealth. Equity investments are widely recognized for their potential to deliver high returns compared to other asset classes like fixed deposits, bonds, or gold.

Why Should You Invest in Equity?

- Higher Returns Over the Long Term

- Historical data shows that equity markets consistently outperform other investment avenues over extended periods.

- For example, the S&P 500 index has delivered an average annual return of around 10% over the last 50 years.

- Inflation-Beating Potential

- Equities can help you combat inflation by offering returns that outpace the rising cost of living.

- Diversification Opportunities

- Investing in a mix of stocks across sectors and geographies minimizes risk and maximizes growth potential.

- Wealth Creation for Financial Goals

- Be it buying a home, funding children’s education, or planning retirement, equities can help you achieve your life goals.

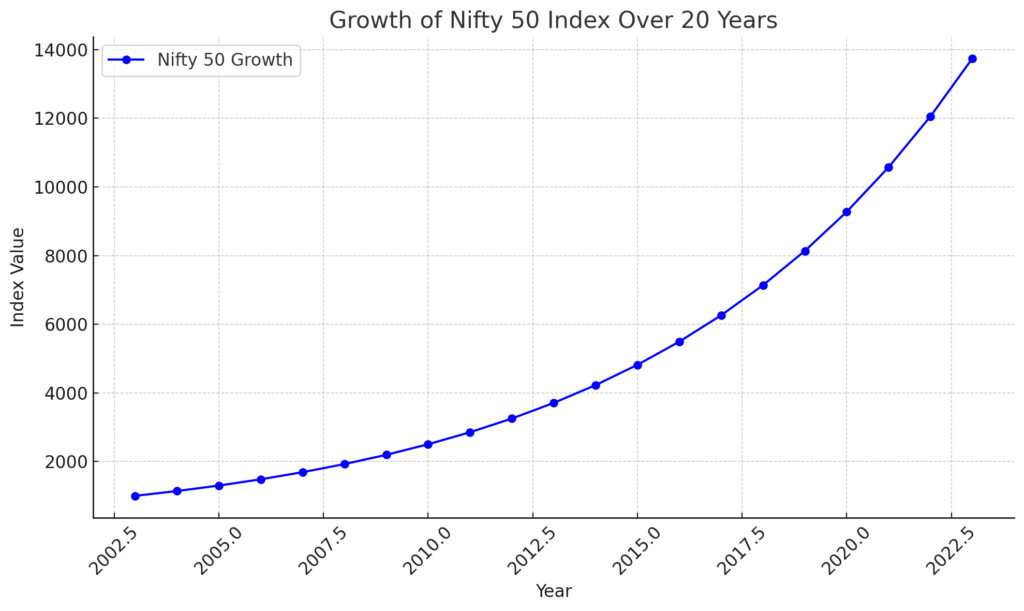

Long-Term Market Insights

Equity markets experience fluctuations in the short term, but the long-term trend is overwhelmingly positive. Consider the following:

Example: Growth of Nifty 50 Index Over 20 Years

| Year | Nifty 50 Value | CAGR (%) |

|---|---|---|

| 2003 | 1,000 | 14% |

| 2023 | 19,961 | — |

Key Takeaway: Markets reward patience. Staying invested during market ups and downs leads to significant wealth accumulation.

How to Start Investing in Equities?

- Set Financial Goals

- Identify your investment objectives (short-term or long-term).

- Understand Your Risk Appetite

- Aggressive investors may focus on growth stocks, while conservative investors can opt for dividend-paying blue-chip companies.

- Build a Diversified Portfolio

- Include a mix of large-cap, mid-cap, and small-cap stocks to balance risk and reward.

- Start with Index Funds or ETFs

- Beginners can consider low-cost index funds to get exposure to the broader market.

- Invest Regularly

- Use a Systematic Investment Plan (SIP) to invest consistently, regardless of market conditions.

How Equity Investments Can Help You

- Achieve Financial Independence

- Over time, compound growth can create a sizable corpus, giving you the freedom to retire early or pursue your passions.

- Tax Efficiency

- Long-term capital gains tax on equities is comparatively lower than many other investment avenues.

- Ownership in Thriving Businesses

- By owning shares in leading companies, you benefit directly from their growth and innovation.

- Emergency Cushion

- Equities can serve as a liquid asset, providing funds in times of need.

Tips for Successful Equity Investing

- Stay Educated

- Understand the businesses you invest in and keep track of market trends.

- Avoid Emotional Decisions

- Stick to your investment plan and avoid panic during market volatility.

- Leverage Technology

- Use stock brokerage platforms and mobile apps for seamless investing.

- Review and Rebalance

- Periodically review your portfolio to align with your goals.

Conclusion: The Path to Financial Growth

Equity investment is not a get-rich-quick scheme but a proven path to long-term wealth creation. By staying disciplined, informed, and patient, you can harness the power of the markets to secure your financial future. Start small, but start today!

References:

Relevant Links and Resources