What is Insurance Porting?

Insurance porting, also known as insurance portability, is the process of transferring your existing insurance policy from one insurance provider to another without losing the benefits accumulated, such as the No Claim Bonus (NCB) and waiting periods for pre-existing diseases.

Insurance portability is a feature introduced by the Insurance Regulatory and Development Authority of India (IRDAI) to provide policyholders with flexibility and better options in the insurance market.

Benefits of Insurance Portability

Porting your insurance policy offers several benefits, including:

- Retention of Accrued Benefits: Carry forward your NCB and waiting period credits.

- Better Coverage Options: Upgrade to policies with wider coverage and more benefits.

- Access to a Larger Hospital Network: Choose an insurer with an extensive network of hospitals.

- Improved Customer Support: Opt for insurers known for faster claim settlements and better service.

- Competitive Premiums: Switch to a policy that offers better value for your money.

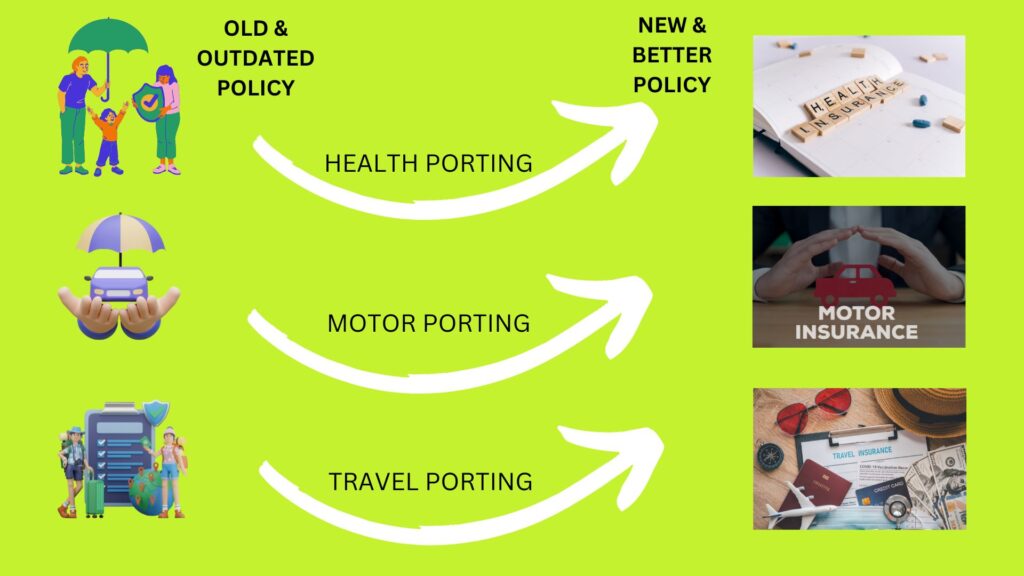

Types of Insurance Policies Eligible for Porting

The following types of insurance policies can be ported in India:

- Health Insurance Portability: Individual and family floater health plans.

- Motor Insurance Portability: Both third-party liability and comprehensive motor insurance policies.

- Travel Insurance Portability: Some travel insurance policies, subject to insurer terms.

Note: Life insurance policies generally cannot be ported.

Who Can Port Their Insurance Policy?

To be eligible for insurance portability, you must meet the following criteria:

- The policy should be active and not lapsed at the time of porting.

- You must submit the porting request at least 45 days before the renewal date of your existing policy.

- The new insurer will assess your claim history, health condition, and other risk factors.

Step-by-Step Guide to Porting Your Insurance Policy

Step 1: Notify Your Current Insurer

Inform your current insurer about your intent to port the policy at least 45 days before the renewal date.

Step 2: Apply for Porting with the New Insurer

- Visit the new insurer’s website or contact their customer support.

- Fill out the portability application form.

- Provide details of your existing policy and coverage requirements.

Step 3: Submit Necessary Documents

Submit all required documents, including policy details, medical history, and claim records.

Step 4: Underwriting Process

The new insurer will review your application, assess your risk, and may require you to undergo medical tests.

Step 5: Approval and Issuance of New Policy

If approved, the new insurer will issue a policy with similar or better coverage, and your accrued benefits will be transferred.

Documents Required for Insurance Porting

To ensure a smooth porting process, you need the following documents:

- A copy of the existing insurance policy.

- Renewal notice from the current insurer.

- Identity proof (Aadhaar, PAN, Passport, etc.).

- Medical history and previous claim details.

- Portability application form from the new insurer.

IRDAI Guidelines for Insurance Portability

The IRDAI (Insurance Regulatory and Development Authority of India) has set specific rules for insurance portability:

- Insurers must process porting requests within 15 working days.

- Insurers are required to transfer the policyholder’s No Claim Bonus (NCB) and waiting period credits to the new policy.

- A valid reason must be provided if the porting request is rejected.

Top Advantages and Disadvantages of Porting

| Advantages | Disadvantages |

|---|---|

| Retention of accumulated benefits | Higher premiums with new insurer |

| Access to better coverage and services | Risk of rejection during underwriting |

| Flexibility to choose a better insurer | New waiting periods for additional covers |

| Better network of hospitals and service | Medical tests may be required |

Common Reasons for Porting Rejection and How to Avoid Them

| Reason for Rejection | How to Avoid |

|---|---|

| Incomplete documentation | Submit all required documents accurately |

| Pre-existing medical conditions | Disclose all health issues upfront |

| Poor claim history | Maintain a good claim track record |

| Delay in porting request submission | Apply at least 45 days before renewal |

Tips to Ensure Successful Insurance Porting

- Start Early: Begin the porting process well before the policy renewal date.

- Research Thoroughly: Compare policies and insurers online to find the best option.

- Maintain a Good Claim History: Avoid frequent or minor claims.

- Consult an Expert: Seek advice from an insurance advisor to understand the best options.

- Keep Track of Deadlines: Ensure timely submission of the portability request and required documents.

Frequently Asked Questions (FAQs)

Q1. Can I port my health insurance policy after making a claim?

Yes, you can port your health insurance policy even after making claims. However, the new insurer will consider your claim history during the underwriting process.

Q2. Will I lose my No Claim Bonus (NCB) during porting?

No, your NCB will be transferred to the new policy, provided the porting request is approved.

Q3. How long does the insurance porting process take?

The entire process typically takes 15 to 30 days, depending on the new insurer’s underwriting process.

Q4. Is there any additional cost involved in porting?

There are usually no additional charges for porting. However, the new insurer may offer a policy with a different premium.

Conclusion

Insurance porting empowers policyholders with the flexibility to switch to better policies and insurers without losing accumulated benefits. By following the right steps and guidelines, you can make a seamless transition to a new policy that offers superior coverage and services.

Looking to port your insurance policy? Contact us today for expert guidance!