What is a BSDA?

The Basic Services Demat Account (BSDA) is a simplified and cost-effective version of a standard Demat account introduced by SEBI to encourage financial inclusion and reduce costs for small retail investors. Key features include:

- Eligibility: Individuals holding a single Demat account with a total investment value not exceeding ₹2,00,000.

- Annual Maintenance Charges (AMC):

- ₹0 for holdings up to ₹50,000.

- Maximum ₹100 for holdings between ₹50,001 and ₹2,00,000.

- Other benefits: Free electronic statements and a limit on charges for physical statements.

If the investment value exceeds ₹2,00,000, the account is automatically converted to a regular Demat account, and applicable charges are levied

What is a Demat Account?

A Demat account acts like a digital vault for holding shares, bonds, ETFs, and other securities electronically. It ensures the seamless transfer of securities and eliminates the risks of loss, forgery, or damage associated with physical certificates

How to Open a Demat Account

- Choose a Depository Participant (DP): Select a DP registered with NSDL or CDSL. Popular options include Motilal Oswal, Zerodha, Angel One, and Groww.

- Document Submission: Provide KYC documents such as PAN card, Aadhaar, bank account proof, and a passport-sized photo.

- Online/Offline Application:

- Fill out the application online on platforms like Motialal Oswal

- Alternatively, visit the DP’s branch (abhaykm)

Verification and Account Activation: After completing the verification process, the DP will provide login credentials to access your Demat account.

Where to Open a Demat Account

Here are the top brokers offering competitive services:

| Broker | Account Opening Fee | Annual Maintenance Charge (AMC) | Features |

| Zerodha | Free | ₹300/year | Flat ₹20 per trade, intuitive interface |

| Angel One | Free | ₹450/year | Research-based advisory |

| Motilal Oswal | Free | ₹400/year | Full-service with personalized support |

| Groww | Free | Free | User-friendly app for beginners |

| Upstox | Free | ₹300/year | Low brokerage rates |

Costs Involved in Maintaining a Demat Account

- Account Opening Fees: Varies; often free with many brokers

- Annual Maintenance Charges (AMC):

- AMCs typically range from ₹300–₹450 per year, depending on the broker.

- BSDA: As per SEBI guidelines (₹0 to ₹100).

- Transaction Charges:

- ₹15–₹25 per transaction for buying/selling securities

- Custodian Fees:

- Nominal charges imposed by NSDL/CDSL for maintaining records.

- Based on the number of securities held

- Dematerialization/Rematerialization Fees:

- Applicable when converting physical shares to digital form or vice versa

- Other Charges:

- Additional costs for off-market transfers, pledge creation, etc

When to Open a BSDA

- If you are a small retail investor aiming for cost-efficiency.

- When your investment value is below ₹2,00,000.

- To benefit from reduced AMC and simpler account management

When Should You Open a Demat Account

- As an Investor: Start when you’re ready to diversify your investments into stocks, bonds, and mutual funds.

- For IPO Investments: A Demat account is mandatory for applying to IPOs.

- Long-Term Goals: It’s never too early to begin investing, even as a student or beginner

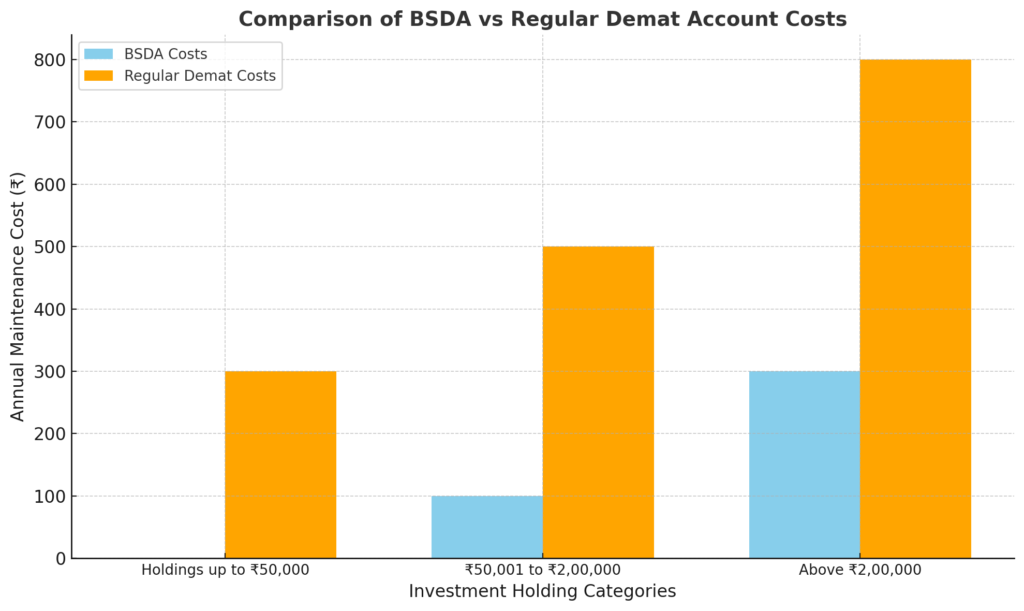

Comparison of BSDA and Demat

Here is a comparison chart showcasing the Annual Maintenance Costs (AMC) for Basic Services Demat Account (BSDA) versus Regular Demat Accounts across different holding categories:

- Holdings up to ₹50,000: BSDA is free, while Regular Demat charges ₹300.

- ₹50,001 to ₹2,00,000: BSDA charges ₹100, while Regular Demat costs ₹500.

- Above ₹2,00,000: BSDA transitions to Regular Demat, typically charging ₹800.

SEBI’s Role and Regulations

SEBI ensures transparency and investor protection through initiatives like BSDA and mandates the following:

- Clear cost structures for all accounts.

- Regular statements and alerts for transactions.

- The availability of grievance redress mechanisms

Benefits of a Demat Account

- Secure Transactions: Reduces fraud and ensures smooth trading.

- Easy Accessibility: Access your portfolio anytime through apps like Motilal Oswal “RISE” app.

- Additional Features: Dividend credit, bonus issue handling, and pledge creation for loans.

Tips for Optimizing Demat Account Usage

- Compare AMC and transaction costs across brokers.

- Stay informed with research reports and market analysis, a specialty of Motilal Oswal.

Conclusion

Opening a Demat account is your first step toward financial growth. With options like free account opening, low AMCs, and robust digital platforms, brokers such as Angel One, Zerodha, and Motilal Oswal cater to every investor’s needs. Start today to unlock the potential of the stock market

References

- Motial Oswal

- Angel One

- Zerodha

- Upstox

- Groww

Relevant Links and Resources